Pensioners Guarantee: Adjusted full state pension will rise to £ 9,300, old base rate to £ 7,200 per year

The government “ triple lock ” pension system will boost retirees’ income by 2.5 percent next April, after what appears to be a bleak winter dominated by the Covid-19 virus and economic hardship.

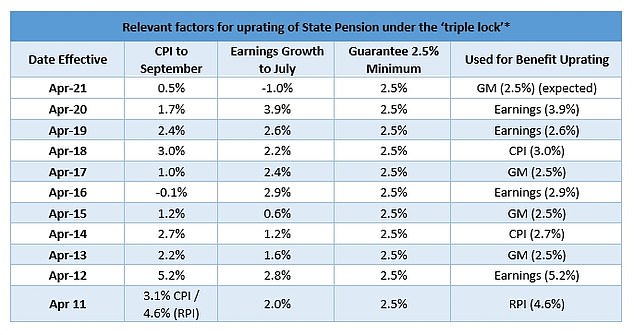

A triple lock means that annual increases in state pensions are determined by what is the highest rate of price inflation, average earnings growth, or 2.5 percent.

Confirmation today that the headline inflation rate for September was 0.5 percent, while wages fell by 1 percent during the summer, means that the third component will be implemented.

The government has so far fulfilled its popular pledge on pensions for older voters.

However, as working-age residents struggle with lower wages and increased job losses, they are likely to face increased pressure to forgo insurance.

From April, retirees are set to receive an increase of £ 4.40 a week to £ 179.60 if they receive the full ‘new’ state pension introduced in 2016, or an increase of £ 3.40 a week to £ 137.65 if They were full “old base price.

That’s around £ 9,300 or £ 7,200 per year in a row – find out why they are so different here.

Financial experts have already warned that a major correction in wage levels following the COVID-19 crisis could mean a massive increase in government pensions in April 2022.

This may spark greater opposition to the triple lock if the nation has yet to recover from the pandemic. Meanwhile, the outcome of Brexit remains unknown until we see what future trade deals with the European Union and the United States will look like.

The Institute for Financial Studies notes that the recent increase means that the nation’s basic pension has risen by 41 percent over the past 11 years, compared to 25 percent if it is related to inflation or 22 percent to earnings growth.

It cites estimates that place the additional cost at 5.6 billion pounds if calculated through this year, plus a further 3.2 billion pounds if policy remains unchanged by 2024-2025.

Advocates of the triple insurance system insist that it is a vital safeguard against the poverty of retirees and that state pensions are not as generous as similar programs in other countries.

Any move to cancel it would lead to a backlash among elderly voters, who have paid contributions to their government pensions throughout their working lives.

Pandemic can advance an appointment when the triple lock is abandoned

“The triple lock ensures that government pension payments do not fall in real terms during periods of economic turmoil,” says Carl Emerson, deputy director of the Institute for Financial Studies.

“There are good reasons to do so. But these pensions will subsequently be increased more quickly in line with the rebound in earnings.

Thus, periods of turmoil such as these lead to an escalation in the value of state pensions while the living standards of the working-age population suffer.

At some point this will prove unsustainable. The current pandemic has shed light on this, and I think it has provided the date when the triple lock was abandoned.

The pledge may face disruption as the government seeks to curb spending

“Retirees are ready to increase government pensions next year,” says Ian Brown, a pension expert at Quilter.

This is despite the difficult economic background with many workers cutting their salaries, working fewer hours than they would like, or losing their jobs altogether.

Even more controversial, however, is the fact that once the vacation scheme ends later this year and if wages recover, the triple lock in its current form will provide an artificially large boost to state pension income in 2022/23 when we could be in trouble. From a deep recession and when the government is struggling to control the deficit.

“Given the Treasury’s recent tab for the government’s response to Covid-19 likely to exceed £ 300 billion, there is still a possibility that the Triple Lock will face a breach next year as the advisor goes to hell in reducing the deficit.

Rishi Sunak: The chancellor said recently that the government will stick to the triple lockdown pledge for voters in last year’s elections

The government is facing calls to spread the costs of the pandemic across generations

“ It might have made sense when it was first introduced, but the world has changed dramatically since then – with no one anticipating the dramatic impact of a global pandemic, ” says Mike Curry, director of investment at Fidelity International.

Under this policy, retirees will see a dramatic rise in their government pensions, while a segment of the working population faces a drastic drop in their income as Covid-19 continues to wreak havoc on consumer and corporate earnings and thus the wider economy. .

It is not surprising that many are calling for a review of the triple lock, or even its removal, and that greater efforts be made by the government to ensure that the cost of the epidemic is distributed evenly among different generations.

“It seems unlikely that we will see any immediate changes in the pledge this aspect of Christmas, but as we move into next year and the dust subsides, these invitations are likely only to rise.”

The fallout from the pandemic could change the triple lock, not cancel it completely

“The millions of people receiving working age benefits will see their incomes drop in April,” says Sarah Coles, a personal finance analyst at Hargreaves Lansdown.

Disability benefits, work and support allowance, job seekers’ allowance, and universal credit are linked to inflation – so they will be boosted by 0.5 percent in April 2021.

However, at the same time, people in universal credit could lose the coronavirus surge, which is worth 20 pounds a week, leaving nearly four million households worse next year.

The crisis has worsened wages as well. When you take inflation into account, by September, it was down 0.8 percent in a year.

“As more people exit the leave scheme, we will likely see average wages recover. However, for those who have been pushed out of vacation and unemployment, this is hardly an improvement.

Triple Lock: What element has been used to increase the state pension over the years? (Source: Aegon)

Next year, assuming the final leave expires, wages are expected to rise dramatically, so the triple lockdown will give government retirees a massive wage increase at a time when the working population is still likely to be on its way back from the economic effects of the crisis.

Many people have been clamoring for time on the triple lock for years, but concerns about its distorting effect on income among retirees and workers in the fallout from the pandemic could turn it over the edge.

This does not necessarily mean canceling some kind of height that is completely guaranteed. We could see 2.5 percent of the pillars removed, or profits eased, so the government could technically maintain the lock while reducing its strength.

A guarantee is a valuable protection for low-income pensioner families

“In the short term, it wouldn’t be a wise solution in the short term,” says Chris Noon, partner at Hymans Robertson.

It is unlikely to provide adequate cost savings in the medium to long term, removes an important safety net for pensioners, and may widen the income gap between working families and retirees.

It is likely that with consumer confidence eventually returning and seeing employment rates begin to recover, inflation and salary increases will exceed the 2.5 percent guaranteed by the triple lock in 2022 and possibly in the years to come.

Therefore, retaining the triple lock is important because it will retain valuable protection for the families of retirees with low incomes.

If the government is looking to restrict government pension increases in the future, a more equitable approach may be to adjust the profit increase criteria to take into account increases over a longer period, which would more closely align employment and retirement income.

The government pension in the United Kingdom remains among the least generous in the Western world.

“ The loss-making increase in government pension inflation will be a welcome boost for many retirees looking to balance household budgets during the coronavirus pandemic, ” says Andrew Tully, technical director at Canada Life.

It further highlights the triple-lock value as retirees get a much higher increase in earnings and inflation growth.

Despite what many might consider a generous increase in the state pension, the UK system remains among the least generous in the Western world.

“Any future attempt to reduce the value of the rise by moving to a double lock system or some other mechanism would risk a dangerous retirement rebellion from millions of voters and it would be foolish for any government to ignore this.”

It can be said that the state pension is still not high enough

“The 2.5 percent security of the measure inside the Triple Lock of the country shows its value and will help protect the income of millions of pensions from next year,” says Becky O’Connor, Head of Pension & Savings at Interactive Investor.

But the fact that it is starting may mean that there is a risk that the Treasury Department decides to tamper with this valuable protection.

Millions of people depend on the state pension to cover their living costs and it can be argued that it really is not generous enough.

The Best Reasons For DIY Retirement Investors

Some of the links in this article may be affiliate links. If you click on it, we may earn a small commission. This helps us fund This Is Money, and makes it free to use. We do not write articles promoting products. We do not allow any business relationship to affect our editorial independence.