Publishing

2021-06-11 09:04

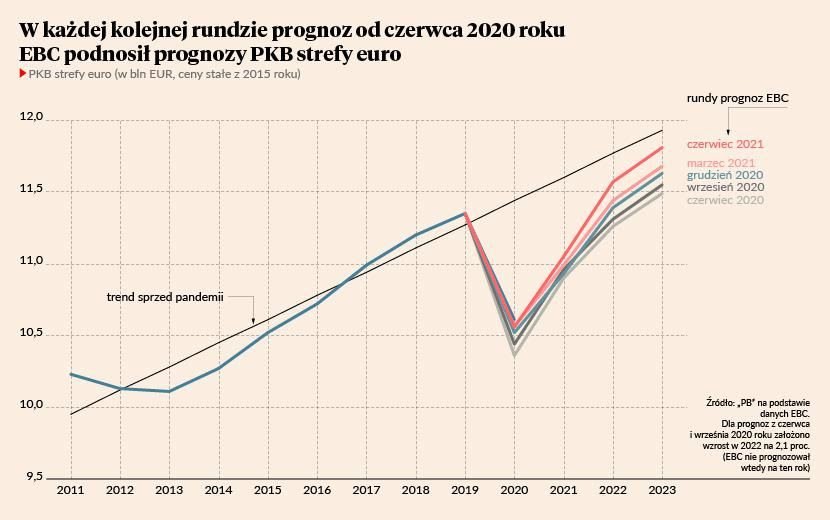

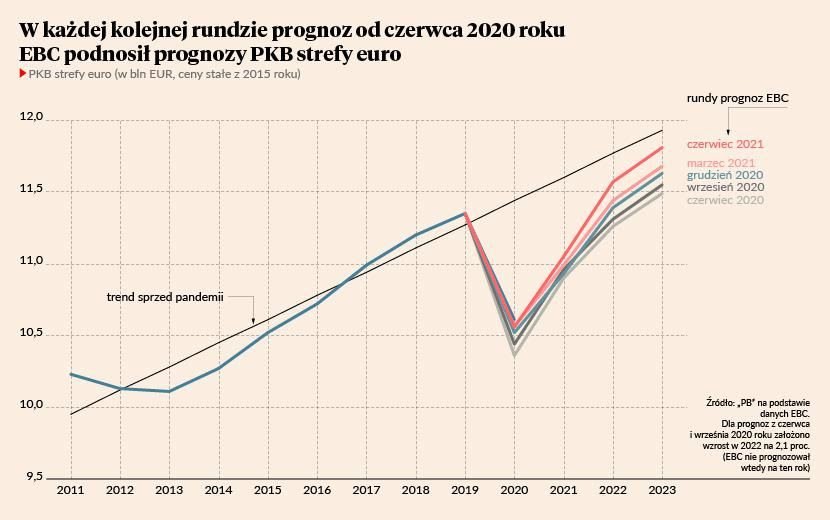

The European Central Bank conducted the largest revision of its macroeconomic outlook for the coming years since the outbreak of the pandemic. Analysts have clearly raised the expected course of GDP, which, according to today’s forecast, will be in about two years at the level that would have been without the crisis. As the graph shows, economists are slowly realizing that the long-term effects of the pandemic don’t have to be negative.

The European Central Bank publishes its forecasts quarterly in the last month of each quarter. They are closely followed, as are the analyzes of all central banks, as they show how the economy is viewed by those charged with managing its stability and keeping inflation in check.

The bank expects eurozone GDP to grow by up to 4.7% this year, by 4.5% next year, and by 2.1% within two years.In all, GDP in 2020-23 is set to increase by 4.1%. (You have to add a decrease for the last year), while in March the total forecast was 2.9%. Contrary to appearances, the review is solid. It is no coincidence that after the publication of the European Central Bank and the conference, President Christine Lagarde, the euro strengthened against the dollar. The move was quite small, but nevertheless, the positive tone of the ECB announcements was outweighed by the pro-dollar data on ultra-high inflation in the US, which reached 5% in May.

It is worth paying attention to one important fact. According to current forecasts, the GDP of the eurozone in 2023 will be only 1%. Below the linear trend prior to the pandemic (i.e. the level that would have been achievable without the pandemic). For comparison: three years after the 2008 financial crisis (ie in 2011), the GDP of the Eurozone was 5.5%. without the previous trend of that crisis. This means that the pandemic crisis has done much less damage to the economy than the financial crisis, and five times more damage to the economy.

Why are the long-term effects of the pandemic so much less than the effects of the financial crisis? There are two reasons. First, the epidemic is a purely external crisis, that is, caused by factors completely independent of the economy. Therefore, it does not cause any deep structural changes, the need for a significant transfer of resources between industries, and political conflicts over who is responsible. Second, the political response to the pandemic crisis has been the result of lessons learned from the financial crisis. At that time, the fiscal stimulus of the economy was very short and after its withdrawal, demand faded and unemployment remained high, which led to a wave of revolutions and small political revolutions. Economists and politicians came to conclusions and this time fired three times the size of the financial artillery, which will also last much longer.

Before we are completely optimistic, that is, the conviction that we will soon be able to fully compensate for all the losses caused by the epidemic, we are in fact only stopped by the fear of a possible relapse as a result of the virus mutating. And vaccinations are very slow.

To what extent should these concerns be taken seriously? I don’t think they should be taken lightly. Something that has been bothering me lately is the rapidly rising tide of the UK pandemic. Not only the number of infections there is increasing, but the number of hospitalizations is also increasing, although the vaccination rate is very high – almost half of the population is vaccinated with two doses (for comparison, in Poland it is less than a quarter, and 50% good winds can reach late summer). Experts are now waiting for indications of how permanent the increase in hospitalization will be, and whether it will translate into a blockage in the hospital system and lead to an increase in the number of deaths (but that is not visible).

It is very likely that this wave will not be as dangerous as the previous one. The reassuring factor is the high efficacy of vaccines against all new variants of the coronavirus. But perhaps it is not yet time to raise the banner of “final victory”. The outlook looks more optimistic, but there is also a hint of uneasiness.