NS Nearly 35 percent foreign investment in the world fell in 2020. Meanwhile, there is more and more money for them. Their release depends on building the newly broken ties of cooperation. The limitation, however, is the fear that cheaper assets will be easier to buy back during the pandemic.

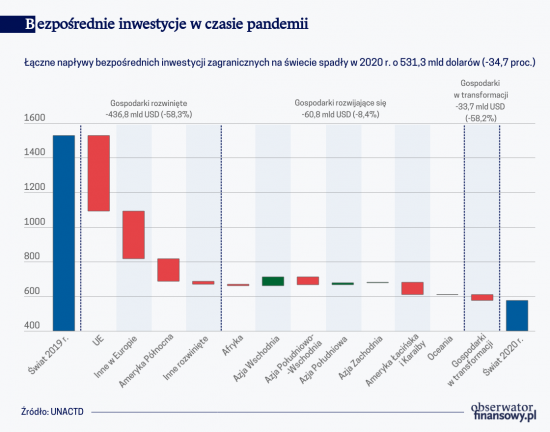

Cross-border investment fell in 2020 from $1,530.2 to just $998.9 billion, according to the report published at the end of June. Abstracts United Nations Conference on Trade and Development (UNCTAD). Compared to the record in this regard in 2016, it has fallen by more than half. In 2020, foreign investment in the world’s most developed countries has shrunk by more than 60 percent – in the European Union, Great Britain and to a slightly lesser extent (by 40 percent) in the United States. Russia is also among the countries largely abandoned by foreign investors last year (a decline of about 70 percent).

Europe is afraid, Asia and Africa attract

The collapse of investment in developed countries contrasts sharply with the significant increase in the value of investments in the Far East, especially in China, where it rose from 141.2 billion dollars. in 2019 to $149.3 billion. in 2020. Taiwan attracted more direct investment (by 6.8 percent) in 2020. Greater growth dynamics were recorded in Laos. In Brunei, its value doubled in the last year (from $275 million to $577 million). In a few neighboring countries (Cambodia and Vietnam) there were decreases, but they were insignificant.

Increases in foreign investment have also occurred in 2020 in several African countries. More foreign capital was attracted, among others, the Congolese countries, the Central African Republic, The Gambia, Guinea and Equatorial Guinea, Gabon, Mauritania, Nigeria, Senegal, Togo, Djibouti, Somalia and Mozambique. In the case of Nigeria and Congo, these differences amount to hundreds of millions of dollars.

The value of foreign direct investments in several European countries has also increased over the past year, despite the crisis of the virus outbreak. The example of Bulgaria is noteworthy, as it rose from $1.7 billion to $2.4 billion. In Hungary, it rose from 3.9 billion dollars. in 2019 to US$4.2 billion in 2020. Last year, Spain, Malta and Estonia also had the highest foreign investment statistics. Against this background – as shown by UNCTAD data – he came out relatively unscathed in the 2020 crisis. Direct investment fell from $10.9 billion to $10.1 billion.

In “Green Meadow”

National foreign investment statistics distort capital transactions within large multinational corporations. It is often one-off and often the result of tax optimization being implemented on a global scale. In the past year, there has been, inter alia, a huge influx of investment funds from funds in companies registered in the Netherlands, as well as in Switzerland. On the other hand, investment funds poured into Luxembourg, as well as the Far East, especially Hong Kong.

There are similar statistical disruptions every year, and for this reason, UNCTAD is likely to use a narrower category to assess trends in foreign investment. Greenfield, That is, the number and value of new (physical) investment projects. The value of these transactions is about half that, but such limited statistics better reflect the actual range of interest in countries by foreign investors.

Projects “on the lawn” are more likely to be located in developed countries.

According to UNCTAD data, the number Greenfield 2020 AD by 29% and its value is 33.3%. (From $846 billion in 2019 to $564 billion in 2020). Projects “on the lawn” are more likely to be located in developed countries. These countries do not attract investors with cheaper labor, but with better infrastructure, education of employees, as well as being less distant from partners and beneficiaries. In an era of rapidly rising ocean freight rates, this is starting to matter.

Values Greenfield Increased in 2020 minutes. In Norway, Belgium, Bulgaria, Slovakia, Estonia, Hungary and Portugal. In Poland, it decreased from $1,574 million in 2019 to $990 million. In 2020, as an example of the trend to locate new and technologically advanced construction in developed countries, UNCTAD experts, however, point to a value of 1.8 billion US dollars investment in the digital sphere of the American company Alphabet, thanks to which Warsaw will become part of the global Google Cloud network . Other European Examples of New Large Investments Greenfield It ia a $6 billion fiber-optic network in Germany, and an investment of $2.8 billion outside Europe. By Amazon in developing IT networks in India.

Money is more than projects

Spending on foreign direct investment, including Greenfield In 2020, it was much less, but wallets with money that can be used will swell. According to the assessment of UNCTAD experts, national and international programs for economic recovery after the crisis related to the coronavirus pandemic will increase the volume of funds for direct investment on a global scale by at least 3.5 trillion US dollars. This is more than 3 times what was spent on it in 2020.

More and more expensive private equity transactions

The expected budget-driven investment boom is likely to encourage private and corporate capital, whose resources are estimated at $10 trillion, to invest. Taking into account the financial assets of pension funds as well as national wealth funds (Sovereign Wealth Funds), the world’s potential investment opportunities increase by $52 and $9.2 trillion. 40 percent of this money is invested in companies listed on stock exchanges, which allows them to be also relatively easy to use for investment purposes.

Investors under surveillance

Such massive and partially quiet money today that can be used for investments, not only evoke positive emotions. This money can be used not only to create new value, but also to easily acquire ownership of existing assets and resources. The time of the pandemic and experience in combating it have shown that the area in which these acquisitions may occur in the coming months and years is the socially and politically sensitive field of health in the broadest sense—from research into new chemical compounds to mass production of vaccines and the development of healthcare networks.

The UNCTAD report draws attention to the changes that have taken place after the outbreak of the pandemic in investment policies in many countries and economic areas. Governments recognize that investments in healthcare require a significant amount of capital. However, at the same time it has become so much more sensitive that external influences of a commercial and political character do not follow the foreign capital required in this case.

A very sensitive topic for health

The list of constraints and restrictions on investment and the countries implementing them is already long and continues to grow. UNCTAD experts noted that as many as 67 countries introduced 152 changes to regulations regarding the quota of foreign capital last year. Less than half of the amendments were editorial in nature, but as many as 50 (compared to 21 the year before) introduced larger restrictions.

There is more and more cruelty in trade in services

The most popular decision was the European Commission’s decision, signed by 25 EU countries, to bring investments from outside the EU under control. Similar screening procedures have also been introduced by countries outside the European Union. Australia fully vetted every foreign capital investment project and extended the application processing time from 30 to 90 days. In Canada, a new regulation has been in place since 2020, reviewing investments in business areas related to biotechnology and vaccine production.

France has added biotechnology to important areas of the economy, which means tightening control over investment projects. From 25 to 10 percent, the odds of buying shares in technology companies with foreign capital were limited. Similar restrictions were introduced in Germany. In Poland, investments from countries outside the European Economic Area (EU and EFTA) require government approvals since last year.

Similar restrictions were imposed by Italy, Finland, Hungary, the Netherlands and New Zealand – almost all developed countries. The introduction of more restrictive measures will prevent the development of direct investment in the world, but is unlikely to stop it completely. UNCTAD experts expect the value of direct investments in the world to increase this year by 15-20 per cent. These increases were confirmed by preliminary statistics for the current year conducted by other analytical centers, including Refinitiv.

>>> UNCTAD on direct investment