2022-01-20 10:36

publishing

2022-01-20 10:36

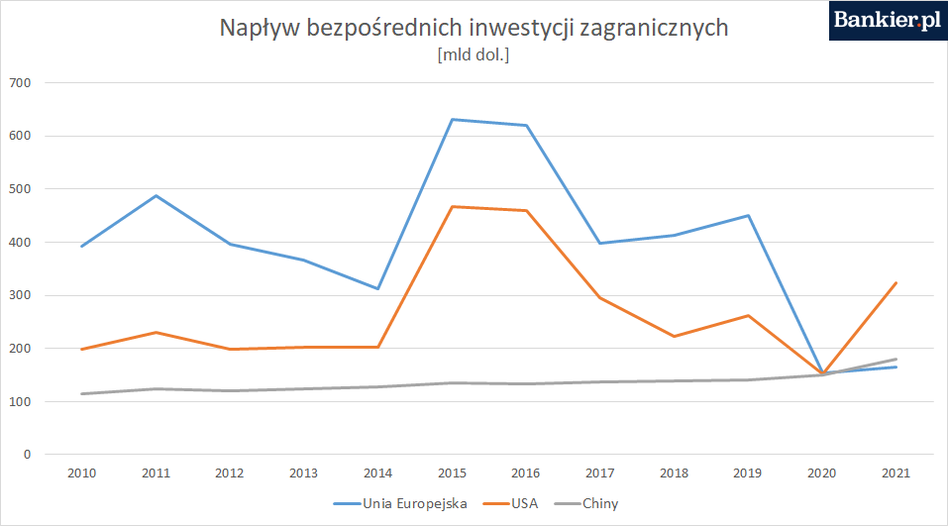

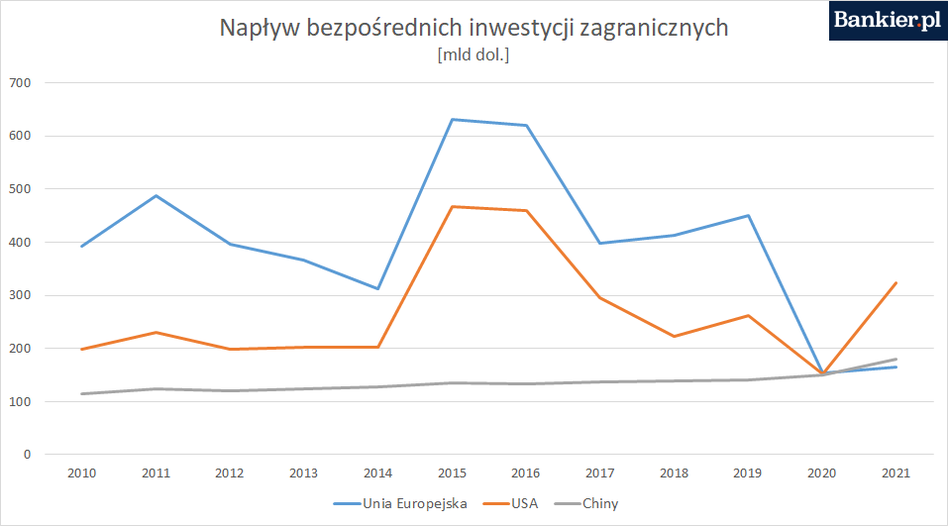

In 2020, China was on the verge of overtaking the United States and becoming the world’s largest destination for foreign direct investment. A year later, the Americans left them again.

$323 billion – this was, according to preliminary estimates, the value of the flow of foreign direct investment to the United States in 2021 – reports UNCTAD. This is more than double the previous year. Meanwhile, investors put $179 billion behind the wall last year, “only” at 20 percent. Over 2020. However, the Chinese overtook the European Union in the race, with $165 billion going.

However, it should be noted that these are preliminary estimates that will be revised in the coming months. This was the case last year, for example, when preliminary information from UNCTAD showed that China had overtaken the United States to become the largest recipient of foreign direct investment in the world.

Moreover, in the case of this data – as well as many others – there are justified doubts regarding comparability between countries, which is important especially with slight differences. In the chart above, the results of the Middle Kingdom are increasing as the ruler. Whereas in other major economies it changes dramatically from year to year. On the other hand, volatility in the case of the United States and the European Union may result from individual acquisitions amounting to tens of billions of dollars. Meanwhile, beyond the wall, the chances of a strong foreign acquisition are much lower – due to the stage of development of most domestic companies and the attitude of the authorities to control the economy.

Foreign direct investment is the acquisition of shares in an existing project or the establishment of a new business entity by a foreign investor. According to international standards established by the International Monetary Fund, it is assumed that an investment is considered direct if the share of the investor is at least 10%.

Foreign direct investment is not the only form of foreign investment. External entities buy, for example, smaller batches of shares in companies that have no control over the business, or debt securities. In this regard, the United States dominates China more. Total US liabilities to foreign investors at the end of last year exceeded 46 trillion US dollars, while in the case of the Middle Kingdom it was 6.5 trillion US dollars. According to the data of the International Monetary Fund.

Maciej Kalwasiński