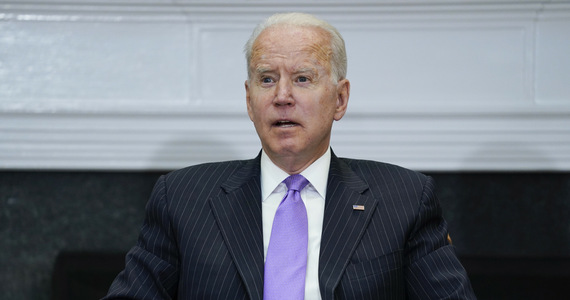

President Joe Biden signed into law a bill Thursday that allows for a temporary increase in the state’s debt limit by $480 billion to $28.5 trillion, eliminating the possibility of a technical US bankruptcy.

On Tuesday, the Democratic-controlled House of Representatives, and formerly the US Senate, opted for such a solution.

In order to avoid the problem of repaying the public debt, short-term measures have been taken in line with the party’s preferences, as Reuters notes. Republicans did not want to agree to a long-term increase in the debt ceiling, as they feared that it would give the Biden administration discretion in financing large investment projects in the social sphere and in the area of climate policy. They stressed the need for the Democrats to take on the task of raising the debt ceiling, “because their policy will require significant budget resources.”

At the beginning of August, the two-year suspension of the US debt ceiling expired, and the Ministry of Finance took the so-called emergency measures to avoid the state’s technical insolvency, which would have very serious consequences for global financial markets.

The United States finances its expenditures by borrowing money – and it sells debt securities issued regularly with various maturities. The United States has never been insolvent, and its government bonds are the safest investment in the world. It is denominated in dollars – the main currency used by central banks and financial institutions around the world. US debt securities are the backbone of the global financial system.